AP Photo/Richard Drew, File

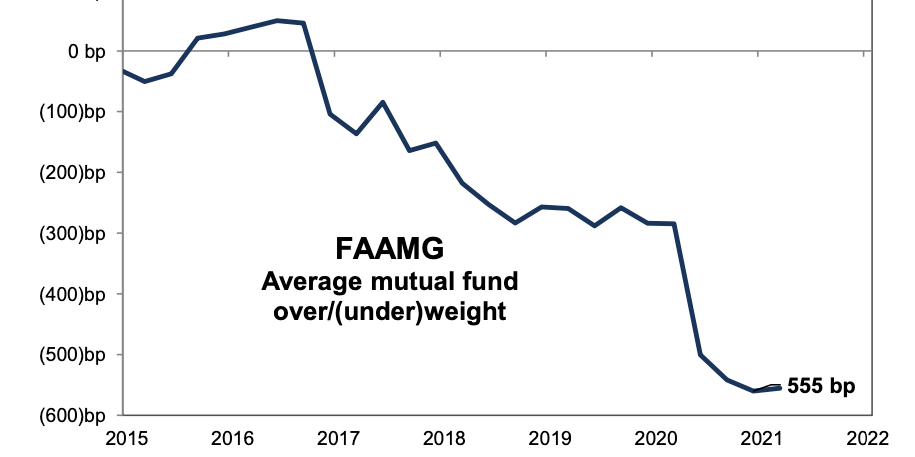

- Mutual funds this year have had near-record-low exposure to FAAMG stocks compared to 2020.

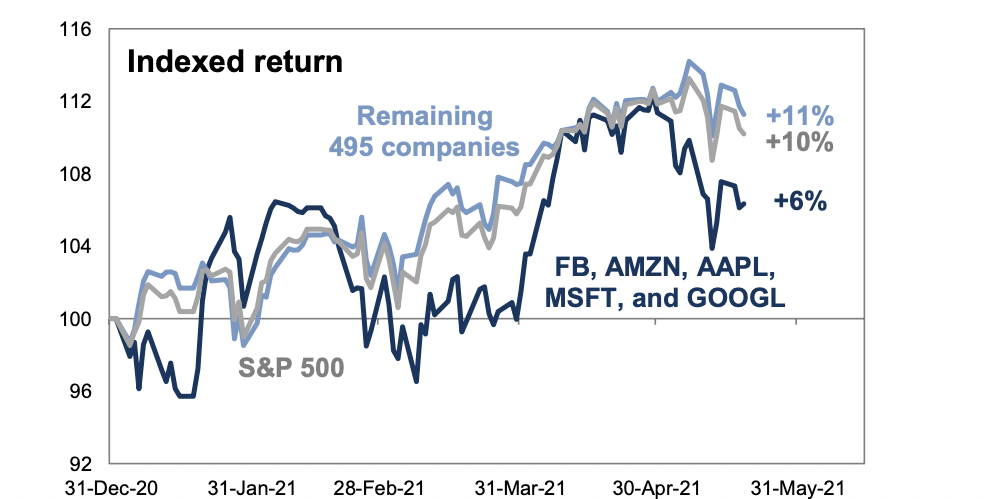

- The underweight exposure has boosted relative fund returns thus far, a report from Goldman Sachs said.

- FAAMG stocks are higher by 6% year-to-date, compared to the 11% gain seen for the remaining 495 S&P 500 companies.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Mutual funds this year have had near-record-low exposure to Facebook, Amazon, Apple, Microsoft, and Alphabet's Google compared to 2020, a factor that has resulted in higher returns so far in 2021.

In general, mutual funds were underweight FAAMG by 555 basis points at the beginning of the second quarter of 2021 – five basis points lower than last quarter's all-time-low, according to a May 21 portfolio research strategy report by Goldman Sachs.

The lack of exposure has been a tailwind, given that FAAMG stocks have slumped this year as investors shift from high growth tech stocks to value stocks set to benefit from the economic reopening.

Source: EPFR, FactSet, Goldman Sachs Global Investment Research

So far, FAAMG stocks are higher by 6% year-to-date, compared to the 11% gain seen for the remaining 495 S&P 500 companies, the analysts said.

In contrast, low exposure was a significant headwind for relative mutual fund returns in 2020, the report, led by Arjun Menon, said, when FAAMG outperformed the broader market.

On average, mutual funds have been underweight since 2016, driven by high index weights and restrictions around portfolio diversification.

Source: FactSet, Goldman Sachs Global Investment Research